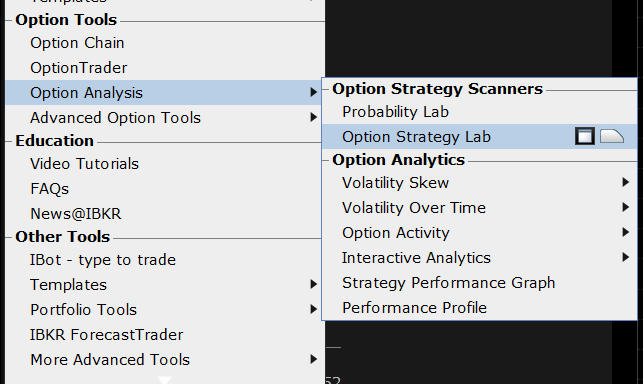

The Interactive Brokers Option Strategy Lab is a sophisticated analytical tool the analyzes the investor’s market predictions and identifies potentially profitable option strategies based on those predictions. The Option Strategy lab can be accessed on the Trader Workstation (TWS) by going to the “New Window” icon in the top left of the screen, scrolling down to the Option Tools area, highlighting Option Analysis and clicking on “Option Strategy Lab”.

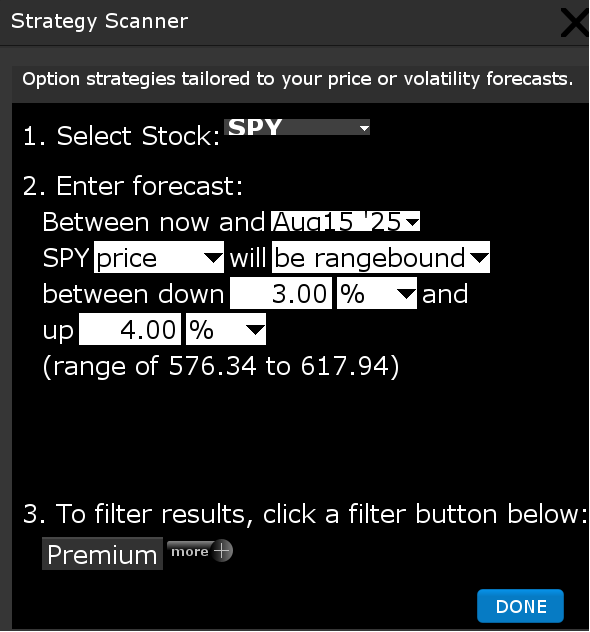

The strategy scanner will appear where the investor can set up their forecast by entering the symbol, then defining their market view by choosing the forecast timeframe (expiration), selecting either price or volatility, then selecting the predicted action. For price the investor can choose between drop, rise, be rangebound, or move at least and then enter the amount in percentage or dollar format. If the investor chooses volatility they choose between drop or rise.

The results can be filtered by premium, delta, strike, and expiration. Once ready the investor clicks on the Done button at the bottom of the screen and the Option Strategy Lab Screen will populate with recommended strategies.

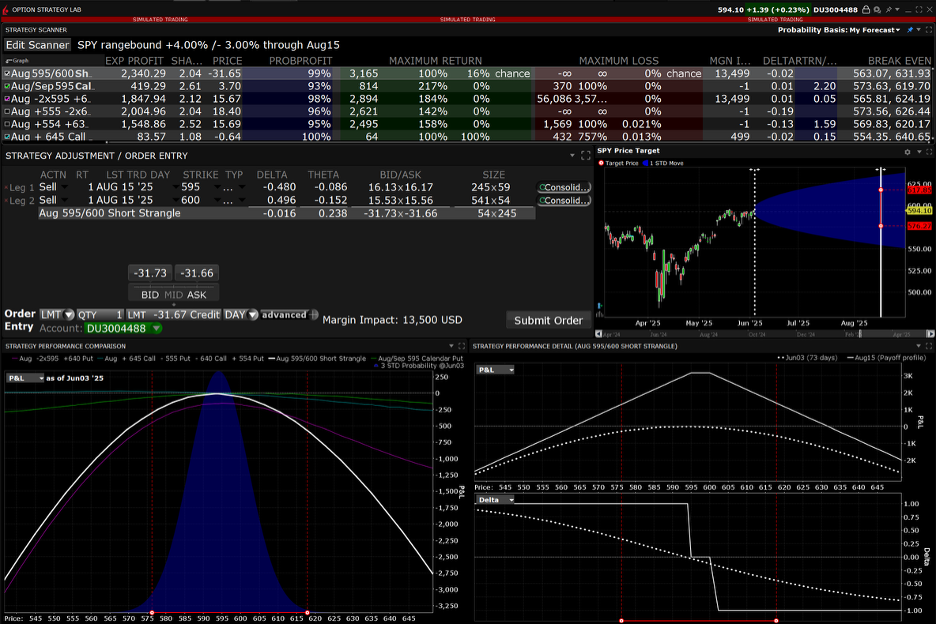

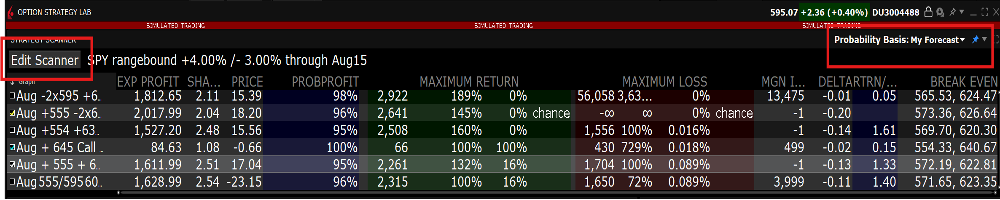

The Option Strategy Lab consists of six areas. At the top is a table of the strategies that may be suitable given the investors predictions. The investor can check off up to five strategies they would like displayed on the Strategic Performance Comparison chart. The table also shows several data points such as expected profit, probability of profit, maximum loss, and maximum gain. The probabilities can be adjusted to see either market implied or based on the investors forecast. It’s important to note that the investor can always edit the scanner by clicking on the edit scanner button in the top left-hand side.

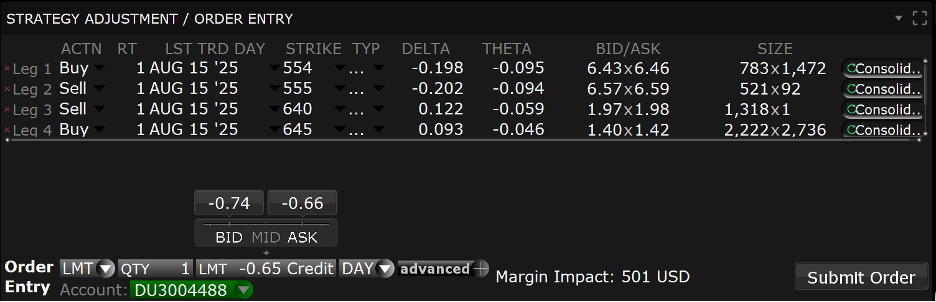

The next area consists of the Strategy Adjustment/Order Entry Panel on the left and the Price Target Chart on the right.

The Strategy Adjustment/Order entry panel will automatically populate with the last strategy that the investor clicks on. It allows the investor to adjust the action, ratio, expiration, strike, and right of the strategy legs as well as delete a leg and adjust the order size and price. When they are ready the investor clicks the “Submit Order” to send the order.

The Price Target Chart is a visual representation of the price forecast with three key indicators: yellow showing the current price, red showing the target price(s) based on the investors forecast, and the blue shaded area representing the estimated price range based on one standard deviation. The vertical line can be dragged to show the range at different dates.

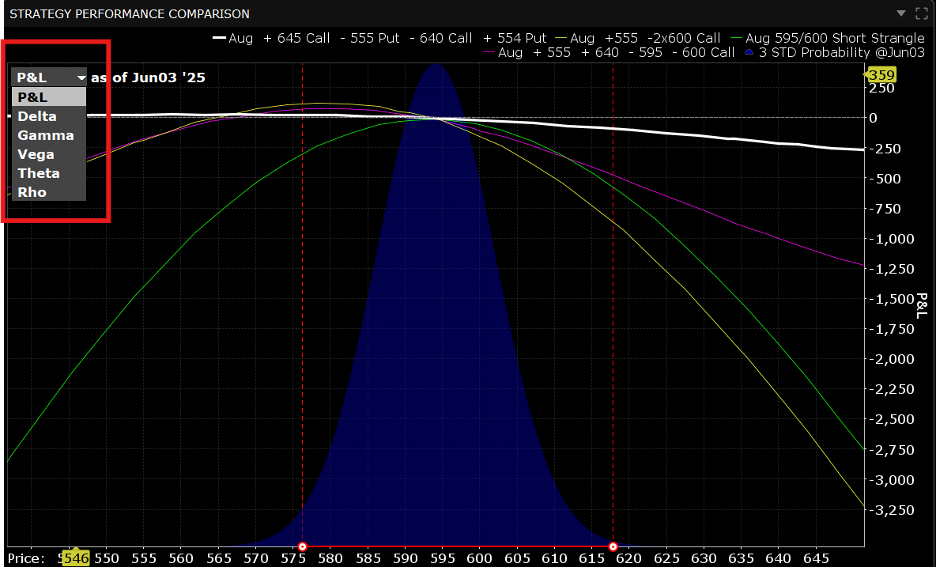

The bottom third of the Strategy Lab consist of the Strategy Performance Comparison Chart and the Strategy Performance Detail charts. The Strategy Performance Comparison supports comparison of up to five strategies simultaneously (selected in the table) and can be adjusted for different metrics including P&L, Delta, Gamma, Vega, Theta, and Rho.

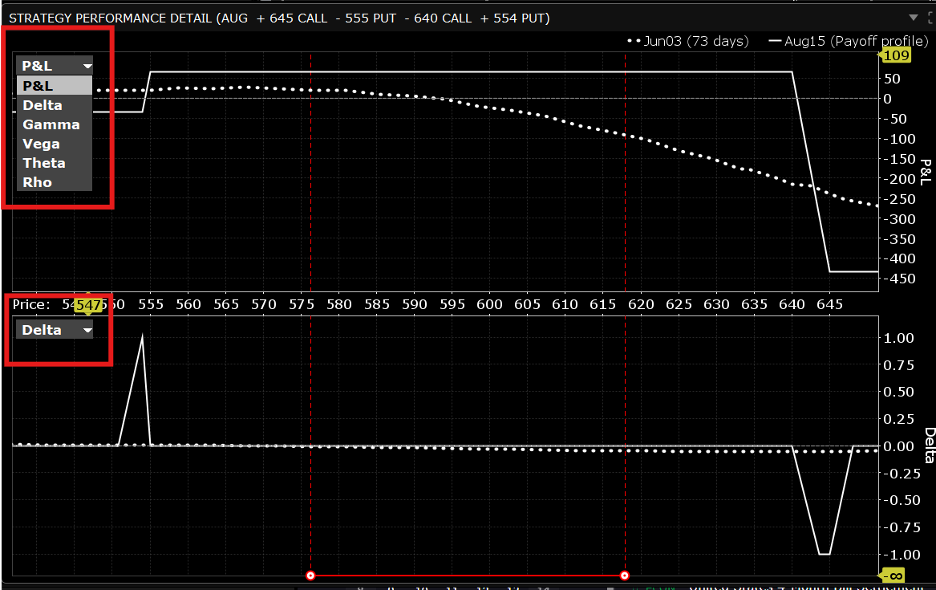

The Strategy Performance Detail Charts provide a close-up view of the selected strategy in which the investor can choose from the seven metrics and see a comparison between today and expiration day values.

The IBKR Option Strategy Lab is a comprehensive trading tool that helps traders identify and analyze options strategies based on their market forecasts, providing detailed metrics and visualizations to evaluate potential trades. Through its integrated interface, traders can define their market outlook, generate matching strategies, compare up to five different approaches simultaneously, and execute trades directly from the platform. The platform offers customizable performance comparisons, detailed charts, and advanced analytics, enabling traders to thoroughly evaluate strategies before execution while considering factors such as profit/loss potential, Greeks, and time decay.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!