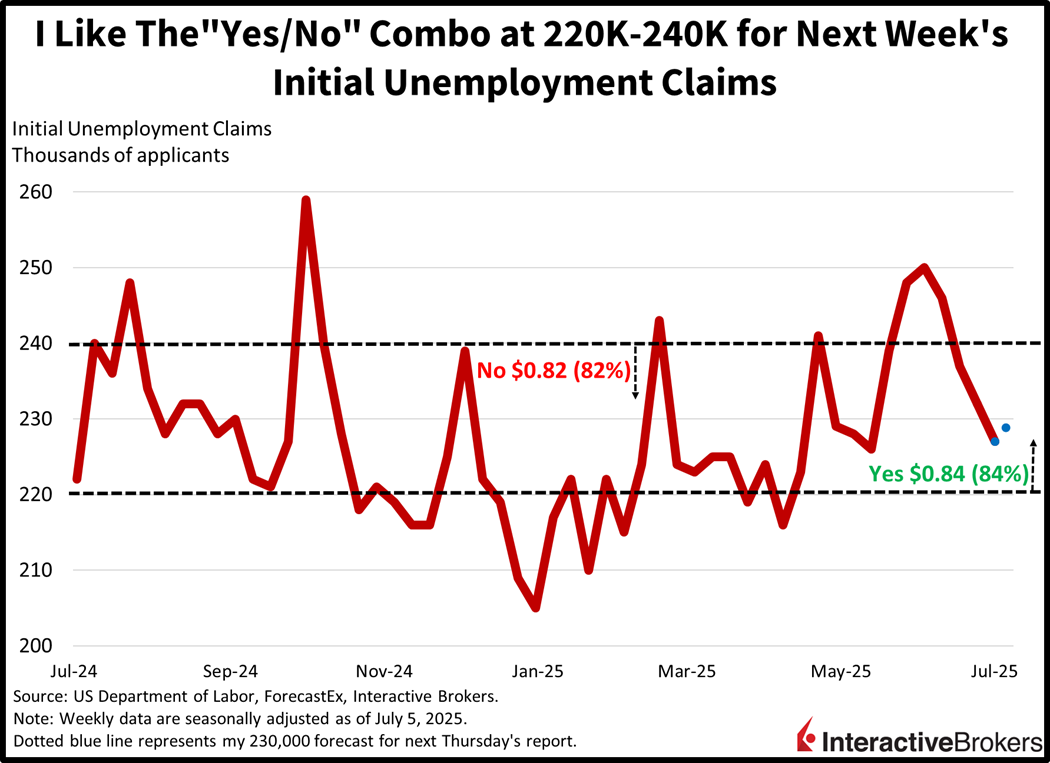

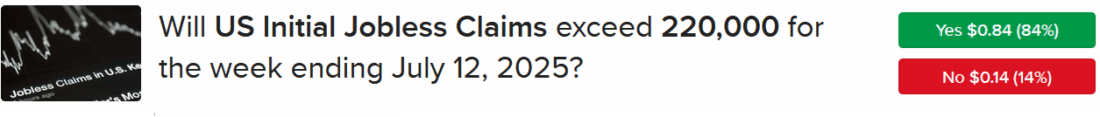

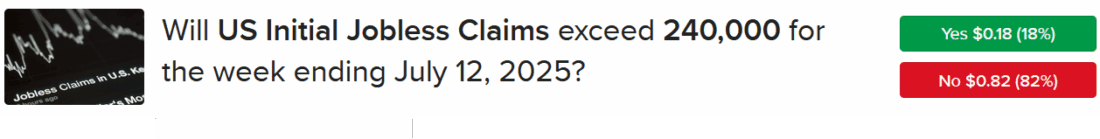

Initial unemployment claims have been plunging, falling from 250,000 in early June to 227,000 last week. The stabilization in the labor market has a lot to do with an increase in relative certainty amongst economic participants and the investor community following an illumination in what was once the long and murky Trump trade tunnel. Cross-border commerce risks are still prevalent, but Wall Street appears much more optimistic about the path ahead than it was several weeks ago and the passage of the GOP’s signature taxation bill has also inspired confidence. Against this improving economic backdrop, I’m expecting first time filings to remain relatively capped and range bound, with my forecast at 230,000 for this Thursday’s print. Furthermore, a Reuters poll of seven economists points to the median estimate at 235,000 with a minimum and maximum of 228,000 and 240,000. In light of my projections and those of my colleagues, I like the risk-reward profile of the “Yes/No” combo at 220,000 and 240,000, priced at $0.84 and $0.82, respectively, for a total of $1.66. The max loss on this position is $0.66 and the combination delivers $2.00 back on a number as low as 221,000 or as high as 240,000. Additionally, folks who purchase these contracts will benefit from receiving a few days of interest-like incentive coupons that currently annualize at 3.83%.

Source for Images: ForecastEx

Note: Prices are highest bids as of the morning of July 11, 2025. Interest-like incentive coupons change proportionally alongside shifts in the fed funds rate.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: Forecast Contracts Risk

Futures, event contracts and forecast contracts are not suitable for all investors. Before trading these products, please read the CFTC Risk Disclosure. For a copy visit our Warnings and Disclosures page.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!