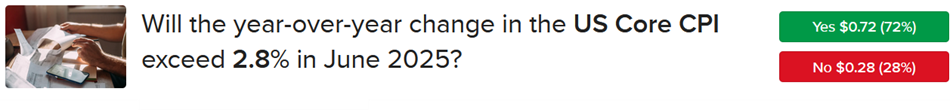

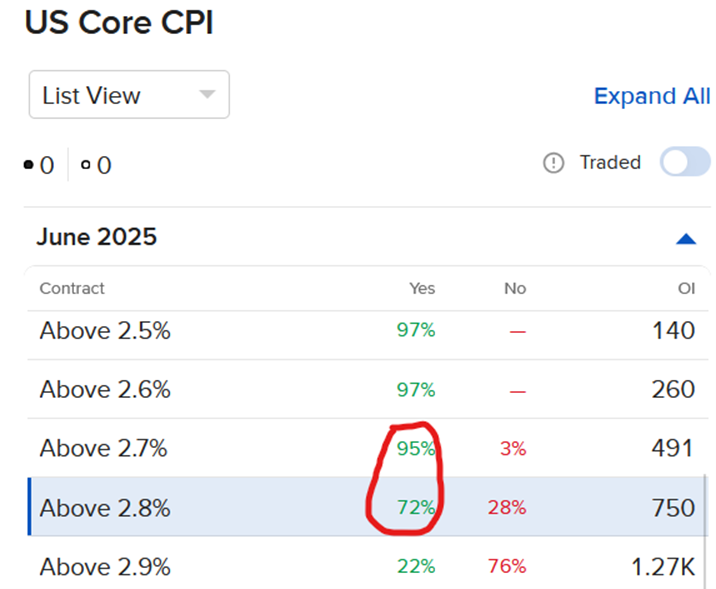

This Tuesday’s June Consumer Price Index (CPI) is expected to reflect annualized advances of 2.7% and 3% across the overall and core segments. Both versions have subdued deviation rates, meaning that they tend to arrive near economist projections. Meanwhile the “Yes” answer at the 2.8% threshold for the core CPI appears undervalued to me at just $0.72. The odds of a 0.2% downside miss are quite low at this juncture and that’s what’s required for “Team Yes” to lose. The probability of a 2.8% figure is closer to 5% based on my forecast of 3%. Moreover, following three consecutive months of 2.8% readings, goods cost pressures are anticipated to drive yearly numbers north in tomorrow morning’s print and that’s another justification for a “Yes” trade here. Furthermore, I also like the risk-reward profile of the 2.7% level at $0.95.

Short Strangle Kind of CPI Forecast Trade

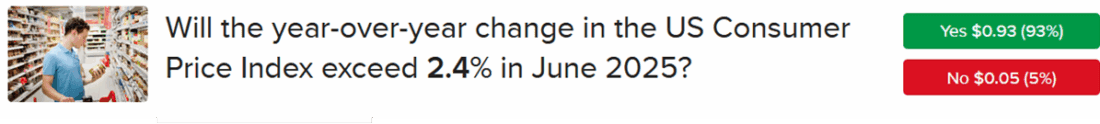

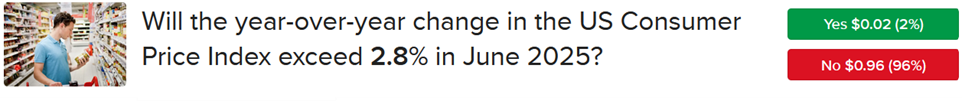

Turning to the headline figure, it is expected to be 2.7%. The 2.4% and 2.8% thresholds look attractive for a short strangle kind of trade, considering you would need a 0.3% downside miss or a 0.2% northward beat for the corresponding “Yes” and “No” answers to lose at the lower and upper thresholds. Indeed, I like the risk-reward profiles of the “Yes” at 2.4% and “No” at 2.8%, which cost $0.93 and $0.96 each for a total of $1.89. The combination delivers $2.00 back on a number as low as 2.5% or as high as 2.8% and the max loss of the trade is $0.89.

Source for Images: ForecastEx

Note: Prices are highest bids as of the morning of July 14, 2025. Red circle around the thresholds was inserted by J. Torres to highlight his preferred “Yes” answers throughout different levels.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: Forecast Contracts Risk

Futures, event contracts and forecast contracts are not suitable for all investors. Before trading these products, please read the CFTC Risk Disclosure. For a copy visit our Warnings and Disclosures page.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!