It is always difficult to spot when markets are taking situations to extremes, and even more difficult to determine whether those extremes are immediately problematic. One must wonder whether traders have become so certain about buying dips that they no longer sell on bad news, fearing they’ll miss a buying opportunity.

Unfortunately, the longer a market environment is taken to or beyond its normal limits, the more painful the eventual resolution. We could be setting up situations where highly sanguine investors might be forced to once again reckon with revised earnings guidance and the eventual implementation of tariffs.

Underlying this situation is the ability for momentum-driven markets to ignore fundamentals. This is a topic that we have discussed at length before, and in detail in a piece we wrote in May entitled When Momentum Rules, Fundamentals are Optional. The key thrust of that article was:

[F]undamentals don’t really matter when momentum rules. Price action, not the underlying justification for those prices, is all that’s important.

We added,

Fundamentals do eventually matter, but the price action can continue without regard to them for long periods of time. In theory, markets are constantly interpreting all available information to find a stable fair values. In reality, they are subject to a wide range of motivations and opinions that might have little to do with that noble search.

When momentum and sentiment are strongly positive, traders can overlook almost anything.

The original piece was written as stocks were recovering from the April swoon. That drop was a reminder that momentum trades can go viciously awry, but that was not the actual catalyst for the comments. We were noting that investors who were intent upon bargain hunting were charitable rather than punitive toward companies who chose not to offer guidance, citing tariff uncertainty:

We’ve seen very charitable responses to corporate earnings in recent weeks. In any normal quarter, a company that withdraws guidance gets punished, and punished hard. Instead, because of the tariff-induced uncertainty, companies are frequently doing so without consequence. They are saying that they don’t have enough information to allow investors to make intelligent valuation decisions about their stocks, yet in many cases, investors don’t care.

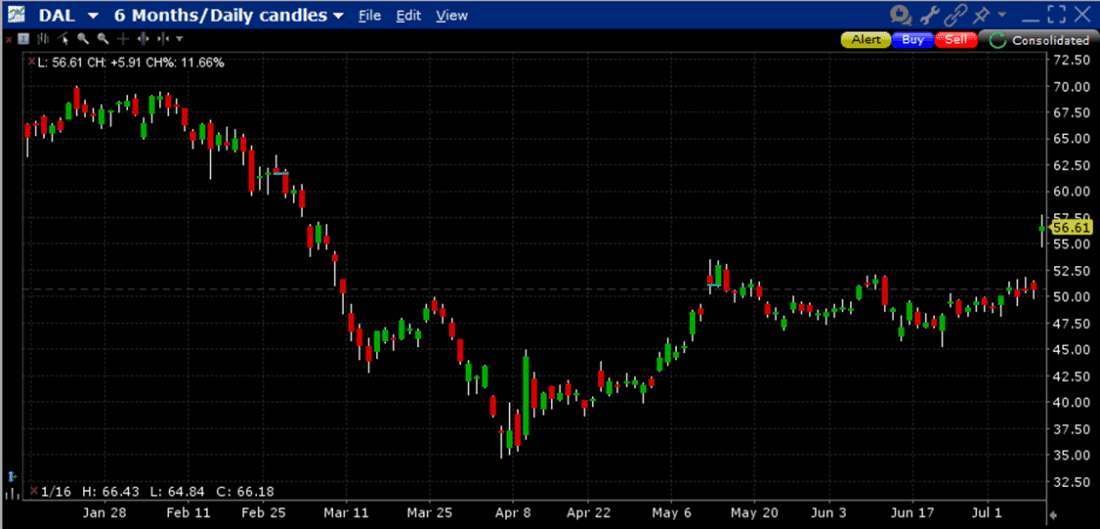

With earnings season beginning in earnest next week, we need to consider whether investors will be quite so charitable this time around. The first piece of evidence came this morning when Delta Air Lines (DAL) rallied over +10% after reinstating guidance that they removed last quarter. The new outlook is for an adjusted profit of $5.25-$6.25 per share, generally well above the prior consensus of $5.35. That is indeed a solid rationale for a rally.

But it is useful to remember that the company predicted earnings above $7.35 when they last offered guidance in January. As a result, even after today’s rally, DAL is not challenging its earlier highs. Will investors be quite so enthused if companies that are trading at or near all-time highs fail to match earlier guidance?

DAL, 6-Months, Daily Candles

Source: Interactive Brokers

Another extreme is the way that traders are essentially ignoring tariff news. Quite frankly, I get it. On Tuesday, in a piece entitled Traders Continue to Call a Bluff on Tariffs, we noted:

Heck, a lot of money has been made by traders betting on tariff malleability – why should they reverse course now?

As long as the market can plausibly assert that there is room for negotiation or extension, then it won’t freak out…

Thanks to the relentless dip buying, the “half-life” of dips has been drastically shrinking.

Something occurred to me when I was asked about the “half-life” comment during a media appearance yesterday. It occurred to me that,

If one is conditioned to see every dip as a buying opportunity, then at some point you don’t even want to react [to bad news] and sell because why sell if it’s only going to go up more?

That sounds perverse, but when we consider the relative sizes of recent selloffs compared to rallies, we have to wonder the degree to which this mentality is embedding itself in traders’ psyches. Broad market dips seem to be getting continually shallower and shorter, meaning that traders are ever more quickly pivoting toward bargain hunting. At some point, do they even bother waiting for the dip, or risk creating one that they will regret by selling on bad news? We’ve seen lasting plunges that stick in individual stocks on catastrophic news, like Centene (CNC), but the news flow that might affect the markets’ leaders has been insufficient to cause a lasting hiccup, let alone meaningful profit-taking.

The environment is increasingly risk-on all the time. This situation can persist for a while, and even get more extreme. It’s impossible to know when the proverbial rubber band gets overstretched, but the longer it goes, the more the risks get buried.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

I don’t mind if they take it higher, not at all, but looking at the 120min chart on NDX, is that a triple top that keeps getting sold intraday…? To quote the famous philosopher, Billy Idol, “In the midnight hour, she cried, “More, more, more” With a rebel yell, she cried, “More, more, more,” wow! One of the 7 deadly sins: Greed (also known as avarice or covetousness): An excessive desire for material wealth or possessions.

I have to admit to experiencing some ROMO over staying small and cautious with trades. Today I saw divergence between price action (slow grind upward) and OBV (expressed on an oscillator) on the 5m time frame. I setup a short for a quick scalp, and a dip began but while the dip looked to have some moderate momentum trying to build, in came buyers and spoiled my bear party. Covered for a small fistful of dollars before buyers drove it back above my entry. Called it a day, went out and trimmed lawn. Mowing tomorrow.

That on on MES, micro e-mini S&P 500 futures.